🚀 WELCOME 🚀

I am a professional trader with years of experience in the financial markets. Throughout my career, I have traded various instruments, refining strategies based on advanced technical analysis, volume reading, and institutional flows. I have honed my skills by studying market dynamics, algorithmic manipulation, and liquidity reactions in highly volatile conditions.

Over the past two years, I have worked to perfect a highly efficient strategy, tested under different market conditions. After a long period of optimization and consistently solid results, I have decided to open this strategy in manual copy trading mode, allowing others to benefit from it. My goal is to provide a well-established and reliable system based on robust technical parameters and advanced risk management.

---

📊 TRADING STRATEGY 📊

✅ Asset: DAX (De4

✅ Leverage: 1:100

✅ Trading Style: Manual, intraday with precise setups

✅ Few and precise entries

✅ Methodology: Volume analysis, liquidity levels, and institutional order flow

✅ Technical Confirmations: Order Flow, Delta Volume, VWAP, Footprint Chart

✅ Daily Profit Target: 1-3%

✅ Maximum Drawdown: -16%

✅ Success Rate: ~98%

✅ Estimated Monthly Profit: 25-40%

🎯 The objective is to leverage algorithmic manipulation and reactions to key liquidity levels to identify high-probability entries. Each trade is backed by detailed quantitative analysis and a strict risk management system.

---

⚠️ RISK MANAGEMENT: STOP LOSS & RECOVERY ⚠️

📌 Trading is not a straight path to profits. Even with a solid strategy, drawdowns are inevitable, which is why risk management is a fundamental part of my method.

🔹 Fixed Stop Loss: Every trade is executed with a predefined stop loss. The maximum expected drawdown is 16%, calculated based on market volatility and average price fluctuations. This ensures capital preservation and sustainable long-term risk management.

🔹 Loss Frequency: On average, the stop loss is hit once every 40 trading days. This statistical data helps maintain a balance between profitability and risk control.

🔹 Recovery Strategy: After a stop loss, the recovery plan follows a structured two-phase process:

- First 5 days: Focus on stability and gradual recovery, with a slightly increased profit target.

- Following 2 days: Trading returns to standard parameters to consolidate profitability.

🔹 Recovery Approach:

✔️ Temporary position size reduction to prevent overtrading stress.

✔️ Focus on high-probability setups, avoiding forced trades.

✔️ Gradual recovery, leveraging risk management to quickly balance drawdown without exposing capital to unnecessary risks.

💡 If analyzed over an annual timeframe, this strategy demonstrates consistent growth with limited drawdowns and fast, efficient recovery phases.

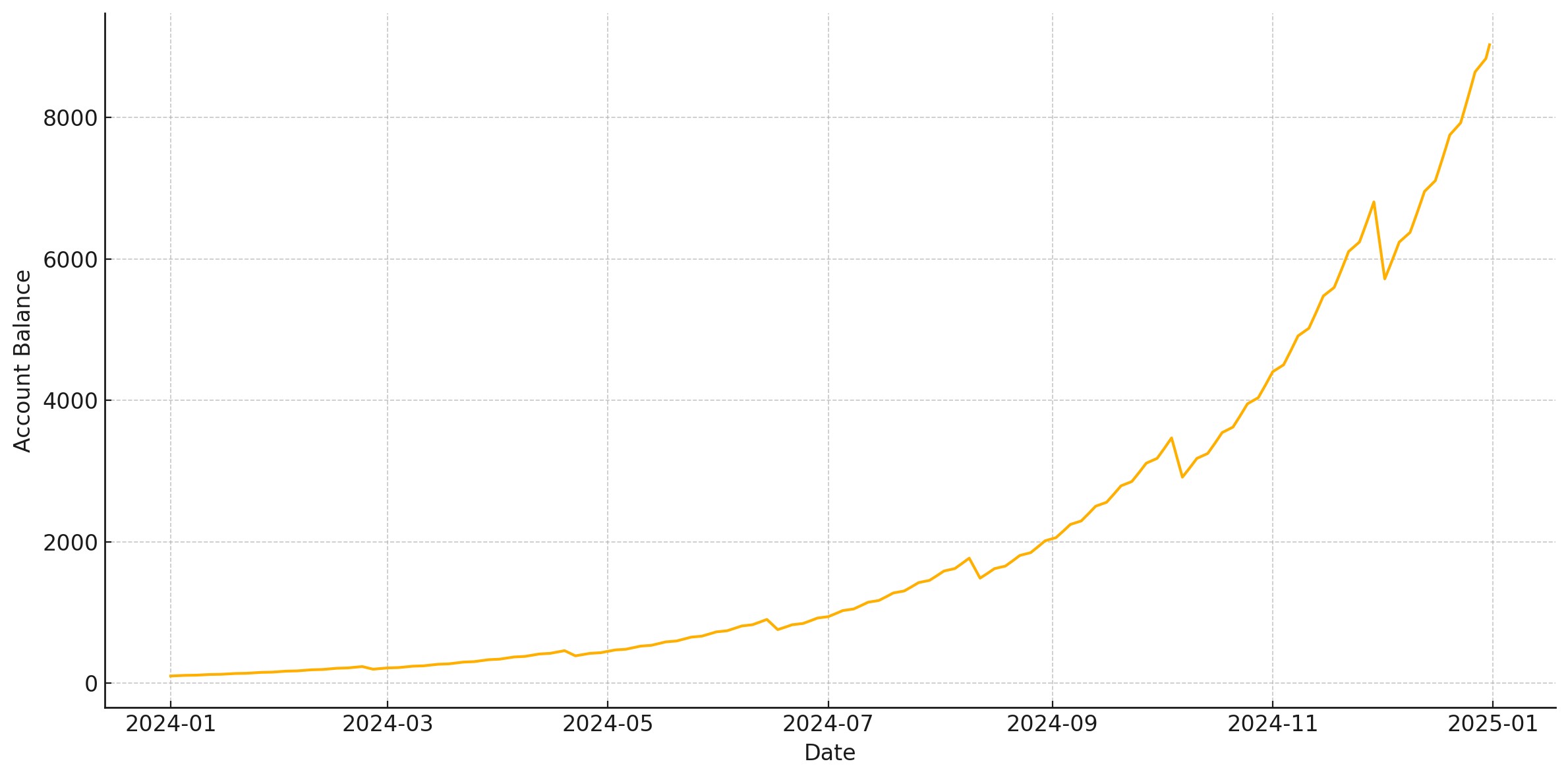

Above is a one-year simulation of the strategy’s performance. The strategy targets an average daily return of 1-3% and increases its trading volume by 0.01 lots for every 100 in the account balance. Approximately every 40 trading days, the strategy may incur a 16% loss, which is then recovered entirely over the next 5 trading days. After the recovery, the growth continues, following the same daily target and position sizing logic. Naturally, the larger the initial deposit, the more rapid the growth will be, due to lot size increments occurring at every 100 units of balance.

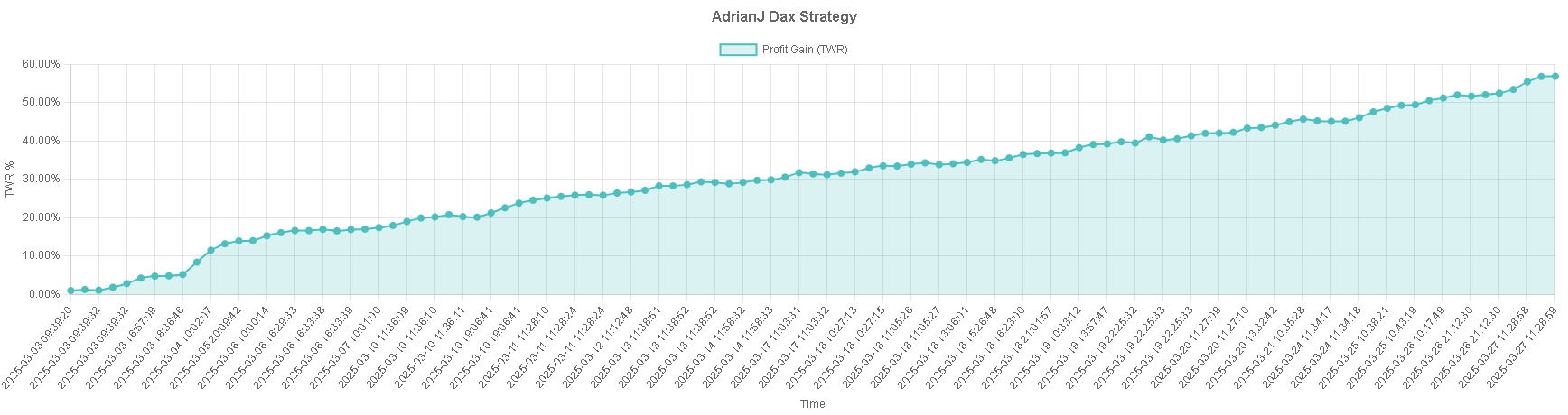

26 Days (Chart without compounding effect)

#adrianjdaxstrategy - 02/03/2025 - 27/03/2025

View Strategy: https://tradingram.in/amt/view...._account_user.php?id

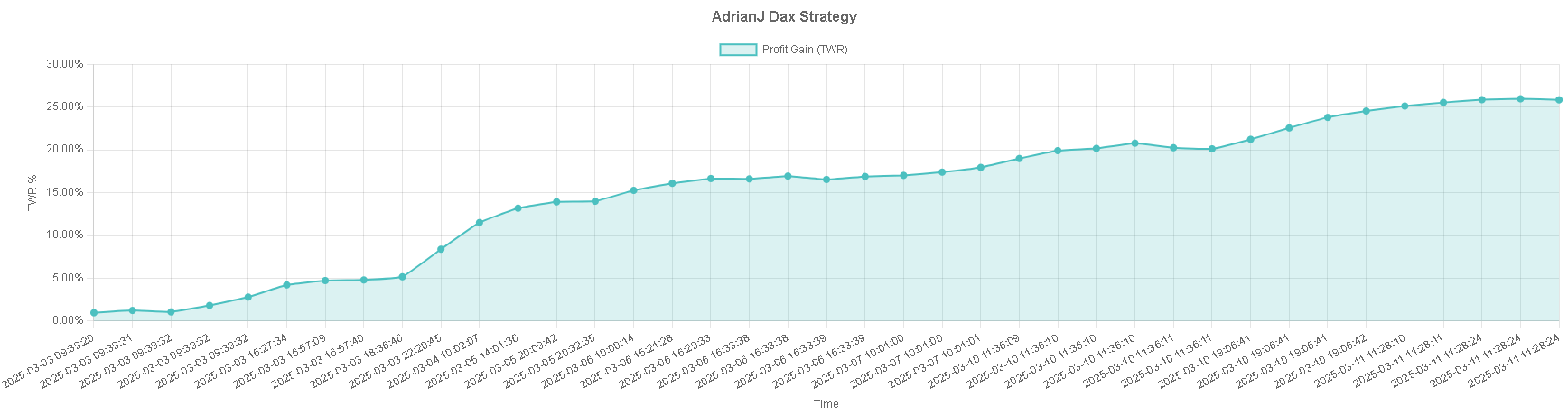

7 Days

#adrianjdaxstrategy - 02/03/2025 - 11/03/2025

View Strategy: https://tradingram.in/amt/view...._account_user.php?id

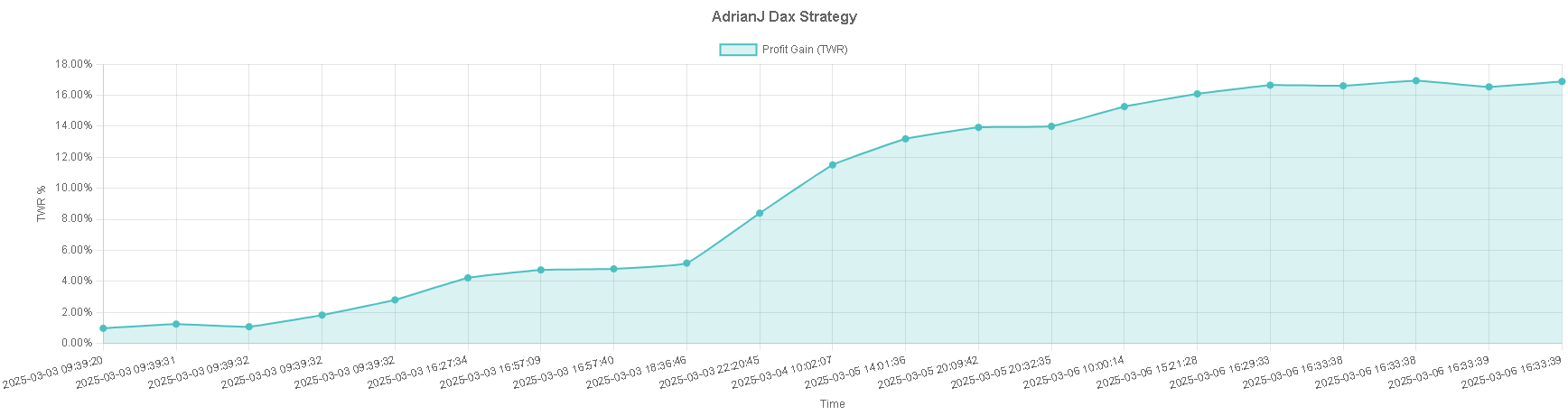

4 Days

#adrianjdaxstrategy - 02/03/2025 - 06/03/2025

View Strategy: https://tradingram.in/amt/view...._account_user.php?id

My goal is to provide a well-established and reliable system based on robust technical parameters and advanced risk management.

✅ Asset: DAX (DE40)

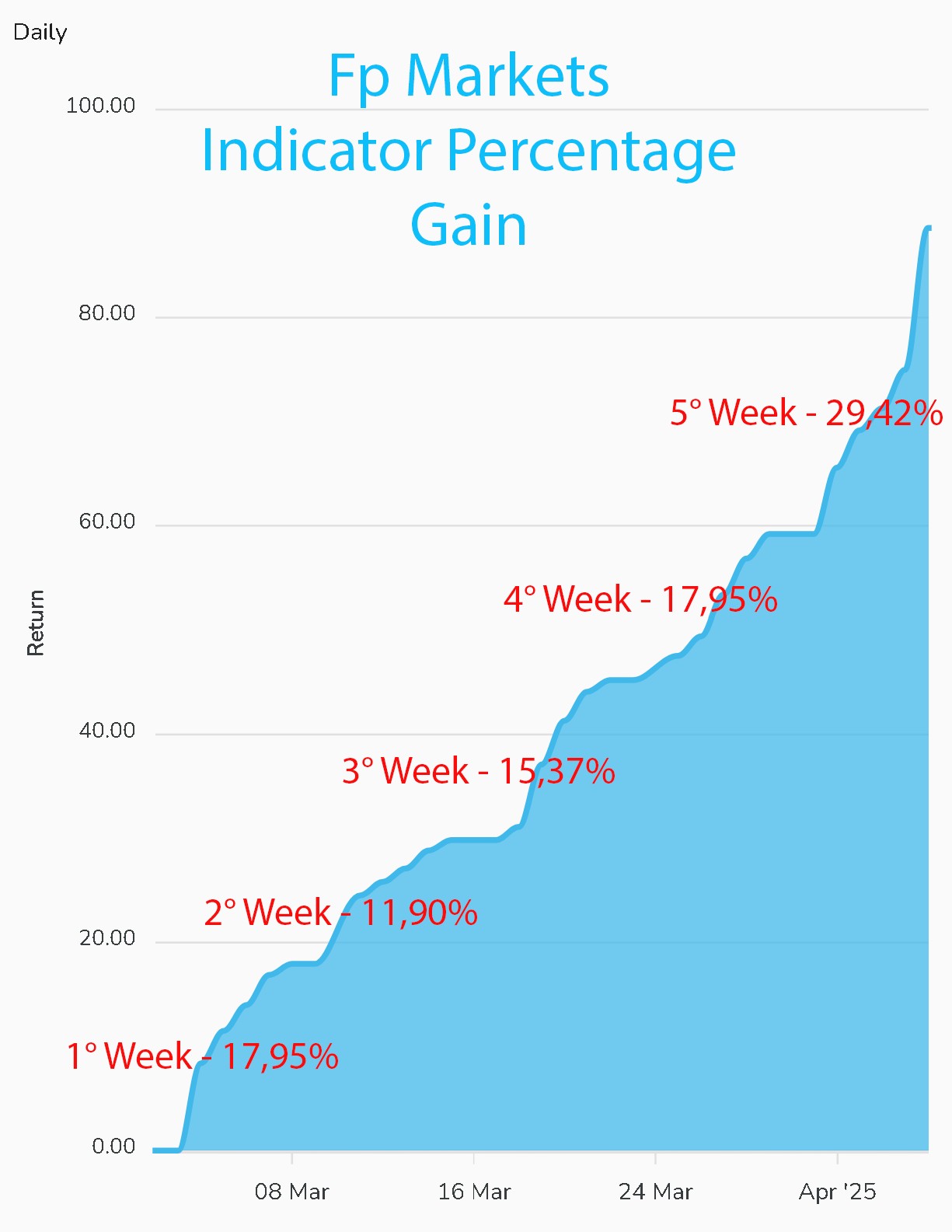

✅Broker: FpMarkets, Raw

✅ Leverage: 1:100

✅ Trading Style: Manual, intraday with precise setups

✅ Few and precise entries

✅ Methodology: Volume analysis, liquidity levels, and institutional order flow

✅ Technical Confirmations: Order Flow, Delta Volume, VWAP, Footprint Chart

✅ Daily Profit Target: 1-3%

✅ Maximum Drawdown: -16%

✅ SL: 18%

✅ SL loss recovery: 5 days

✅ Success Rate: ~98%

✅ Estimated Monthly Profit: 25-40%