DAY 4

#adrianjdaxstrategy - 17/02/2025 - 24/02/2025

View Strategy: https://tradingram.in/amt/view...._account_user.php?id

Discover postsExplore captivating content and diverse perspectives on our Discover page. Uncover fresh ideas and engage in meaningful conversations

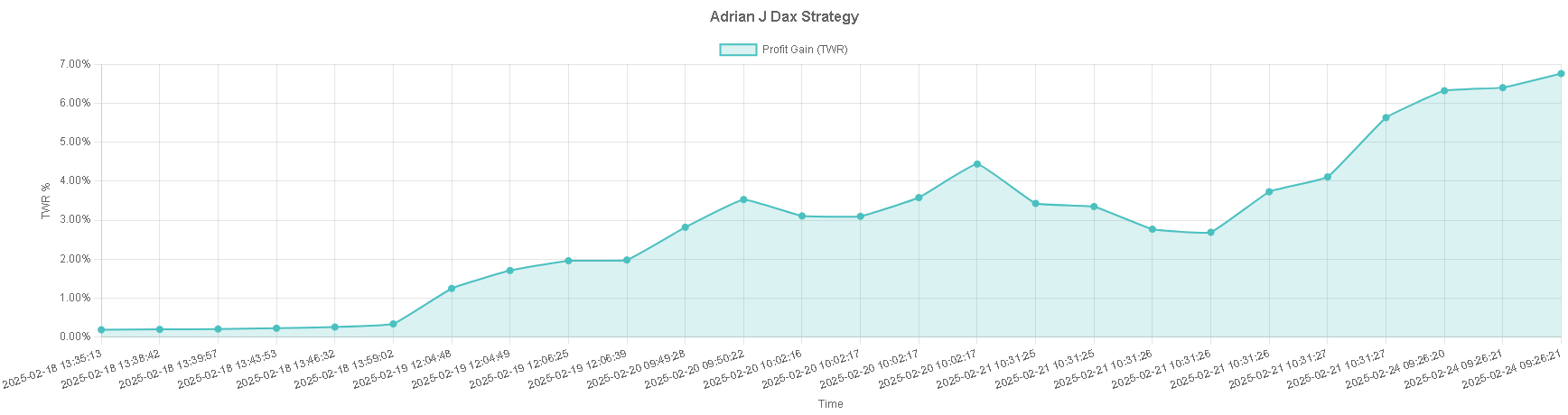

DAY 4

#adrianjdaxstrategy - 17/02/2025 - 24/02/2025

View Strategy: https://tradingram.in/amt/view...._account_user.php?id

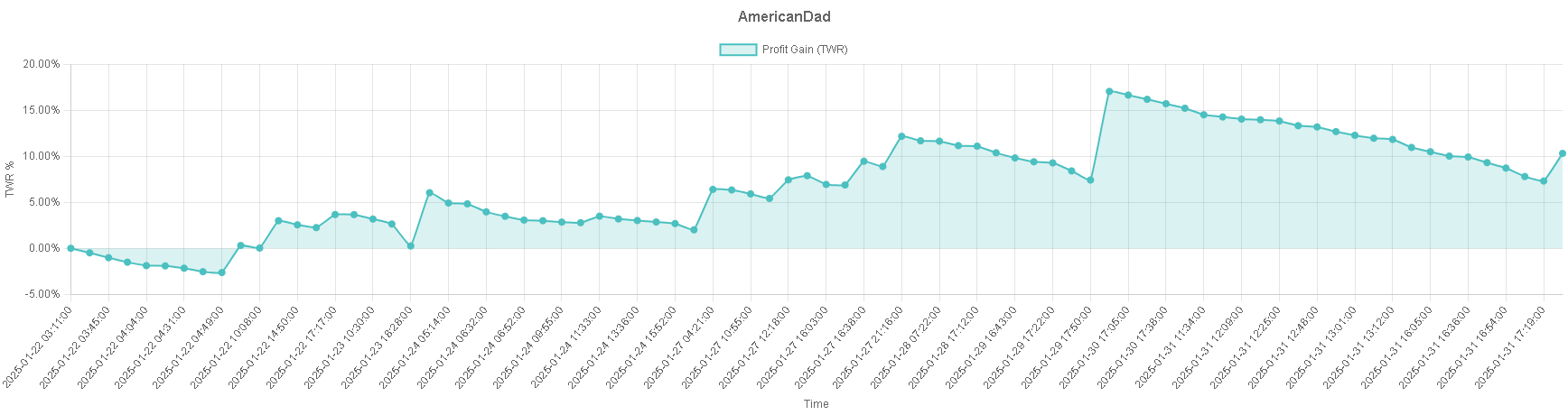

#americandad - 22/01/2025 - 31/01/2025 View Strategy: https://tradingram.in/amt/view...._account_user.php?id

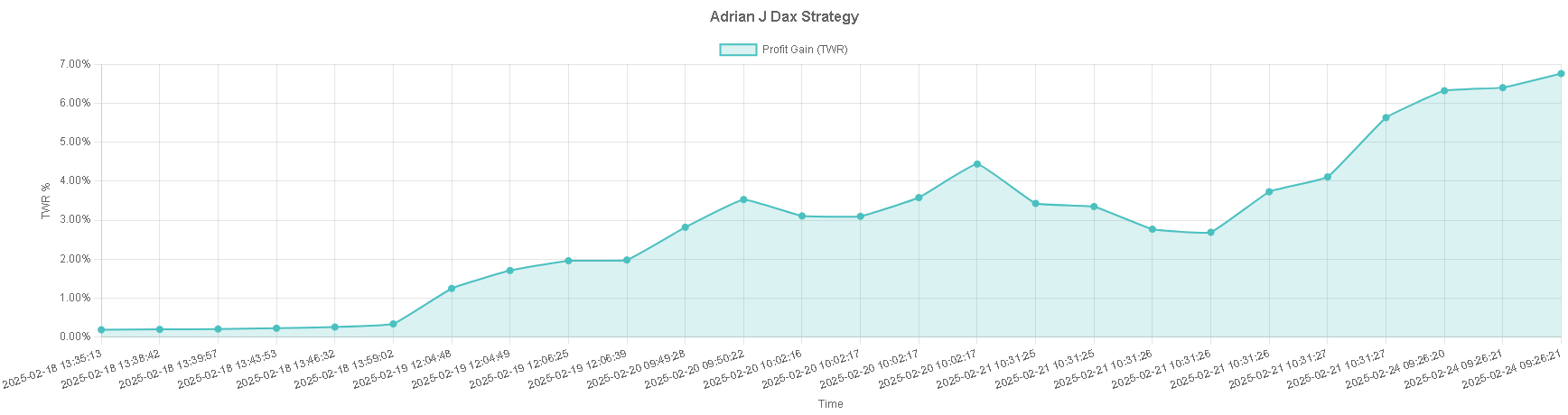

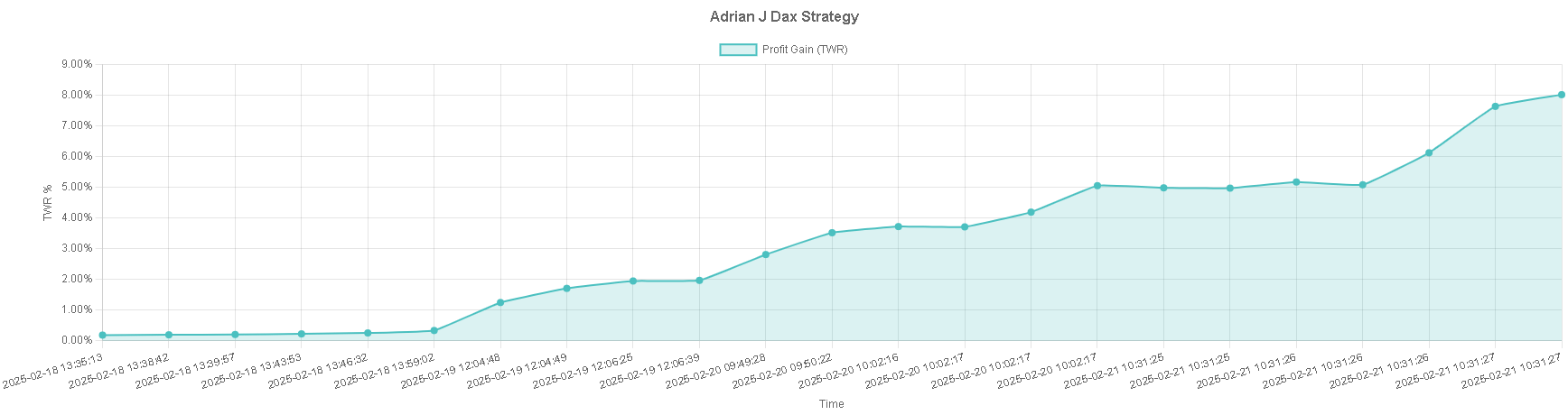

DAY 3

#adrianjdaxstrategy - 17/02/2025 - 21/02/2025

View Strategy: https://tradingram.in/amt/view...._account_user.php?id

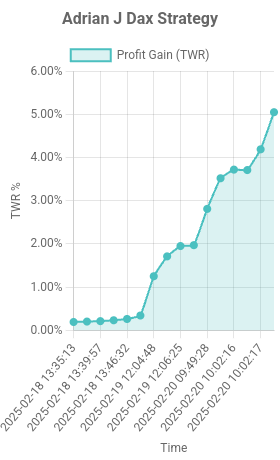

DAY 2

#adrianjdaxstrategy - 17/02/2025 - 20/02/2025

View Strategy: https://tradingram.in/amt/view...._account_user.php?id

I would like 1:500 leverage on Fpmarkets. Can someone answer? I also opened a topic here: https://tradingram.in/forums/19

Forex Market Analysis – 2025 and Beyond | #2025

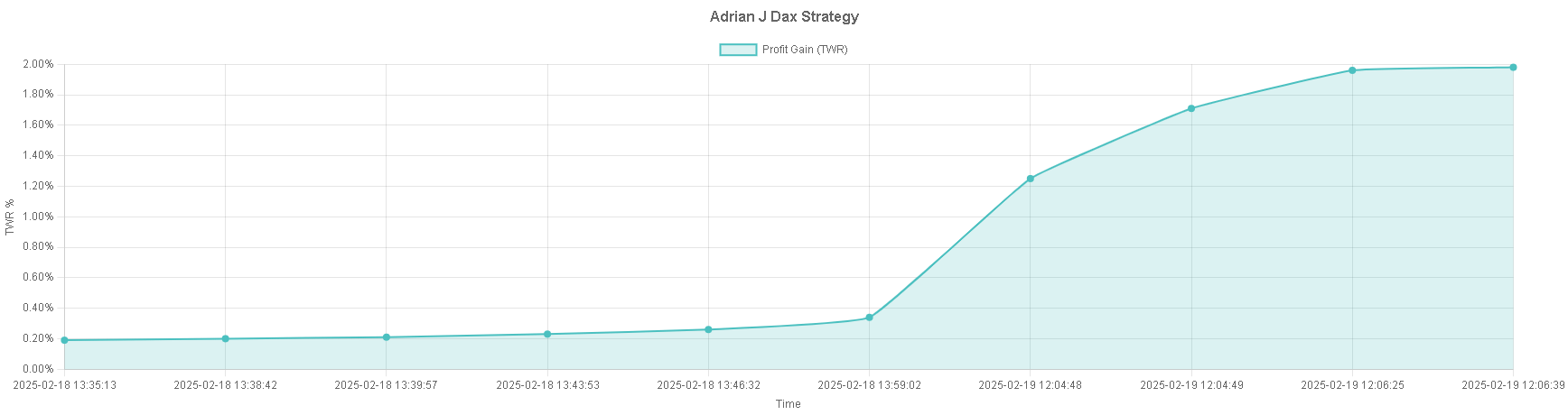

DAY 1

#adrianjdaxstrategy - 18/02/2025 - 19/02/2025

View Strategy: https://tradingram.in/amt/view...._account_user.php?id